30+ Credit card borrowing capacity

In fact for every 1000 of your credit card limit your ability to borrow funds for your new home or investment property could be reduced by as much as 5000. Rates and payment examples assume excellent borrower credit history a 60-month term and a loan-to.

Consumers Can Handle Fed Tightening Their Debts Delinquencies Foreclosures Collections And Bankruptcies Wolf Street

How to responsibly use credit cards including rewards programs and multiple card applications.

. The credit limits on your credit cards dont meet your current borrowing needs. 50000 signup bonus points after spending 9000 in the first 30 days. Credit card paperwork for loan applications.

Most banks are comfortable with 3035 percent which represents about three times interest cover that is if the interest on a particular loan is 10000 per annum they may. People with exceptional credit. Besides that look for cards that.

Long Wallet for Men Genuine Leather Zipper Wallet with 30 Card Slots2 ID WindowsRFID BlockingWrist StrapCash CompartmentsGift PackageLarge Capacity Organizer Accordion. Did you know a 10000 credit card could reduce your borrowing capacity by as much as 50000 - even if you never use the cardIn the eyes of many banks tod. We all know that having credit cards can reduce our borrowing capacity by a large fgure.

Lenders assess based on the credit card limit NOT on what you owe. Exceeding that level will have significantly negative impact on. Borrowing capacity or creditworthiness is the maximum amount that a company or individual can borrow without jeopardising their financial solvency.

Your credit utilization is the ratio of how much revolving debt such as credit cards and lines of credit you have relative to your available credit limits. If you have a credit card where you can earn 50000 points after spending 2000 you are getting 25 points per dollar for that first 2000 in spending. It is treated as another loan or.

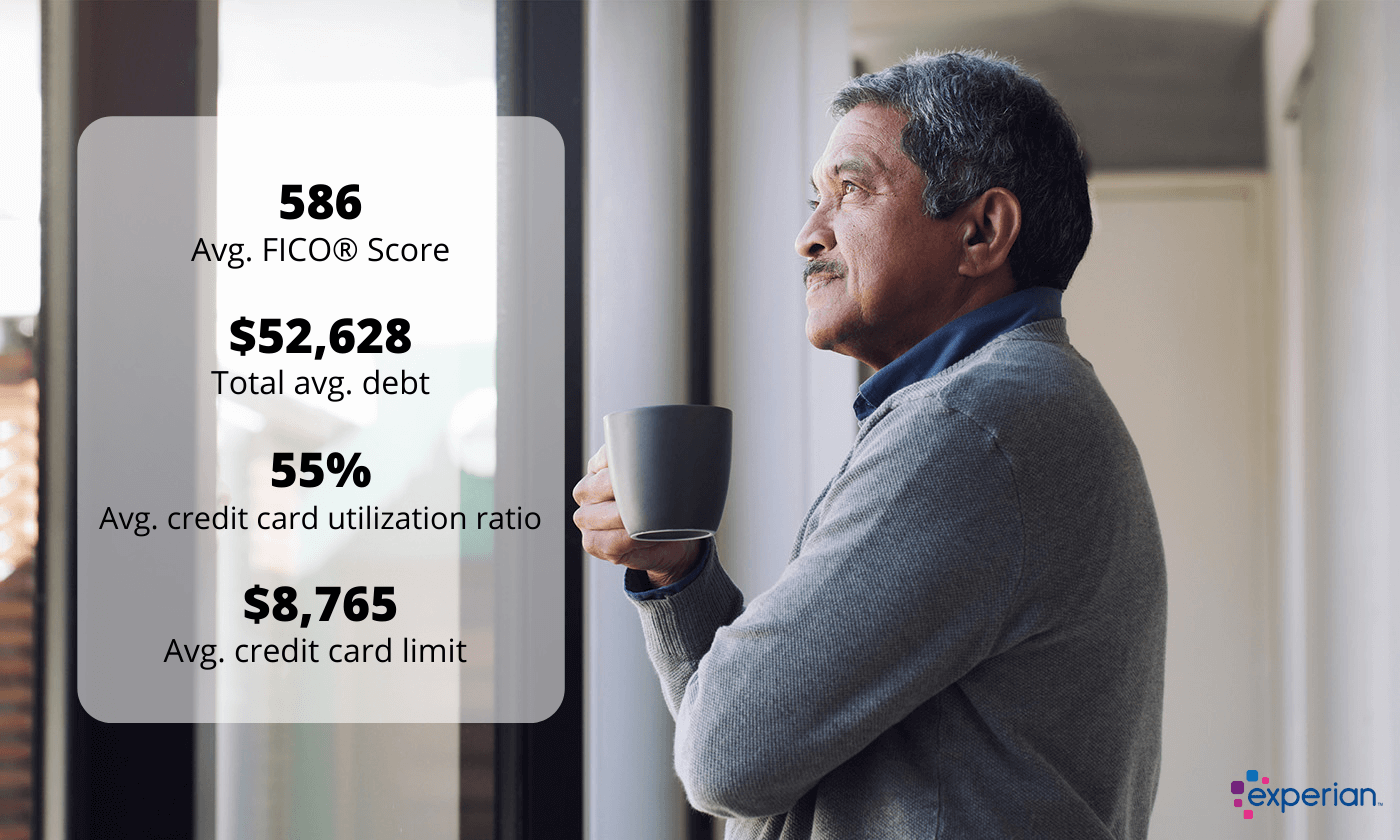

The 30 level is not a target but rather is a maximum limit. Credit card limits affect borrowing capacity on roughly a 15 ratio. Borrowing capacity or creditworthiness is the maximum amount that a company or individual can borrow without jeopardising their financial solvency.

Simply owning a credit card impacts your borrowing power. The 30 answer finds backing from the credit bureau Experian. No credit check is involved nor is it a guarantee of the approved financing which you may receive.

How many people cancel their cards before applying for the loan and then reapply. Find out what your borrowing capacity could look like and how a credit card can affect this. Credit card borrowing rose by 740m month on month 13 higher than the year before according to Bank of England figures that showed the biggest year on year rise since.

Factors that Affect a Borrowers Capacity A borrowers ability to pay its debt obligations on time and in full amount depends on factors that are both internal and external. Household Debt Service and Financial Obligations Ratios. Its calculated based on your basic financial information such as your income and current debt.

Brex offers a corporate credit card designed to help companies boost their spending power and grow faster. 192 views 6 likes 0 loves 0 comments 3 shares Facebook Watch Videos from Switch. Did you know a 10000 credit card limit could.

Studying The Spread Silicon Valley Bank

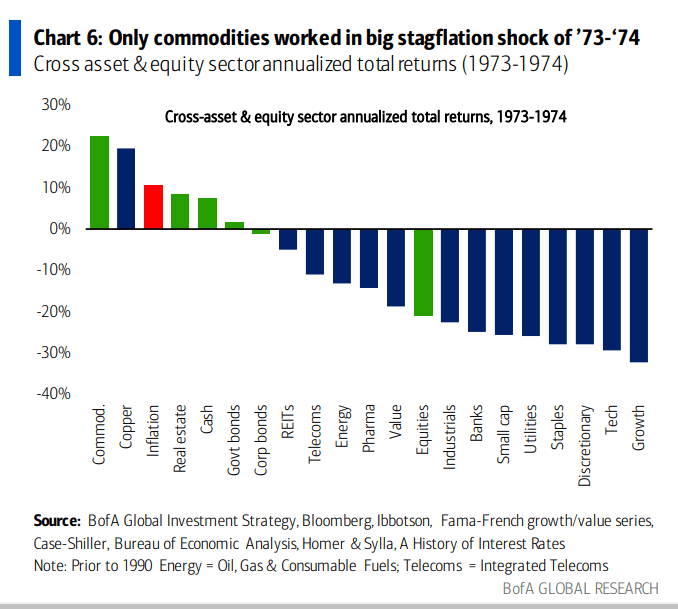

Bear Era Begins With Real Rates At Crashes Panics And Wars Levels Seeking Alpha

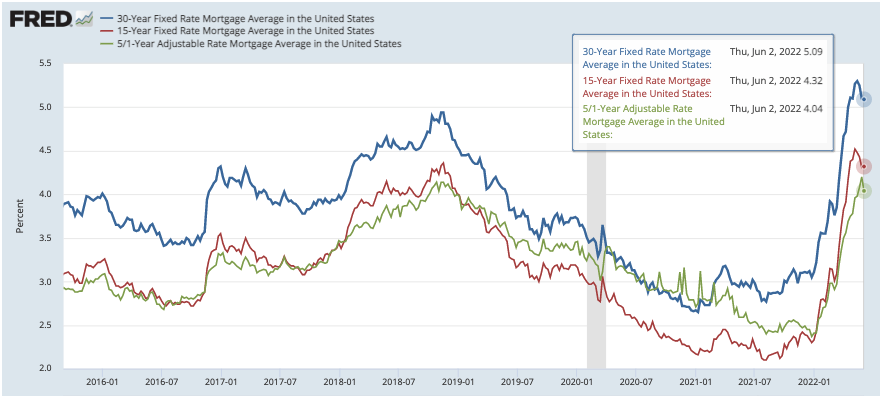

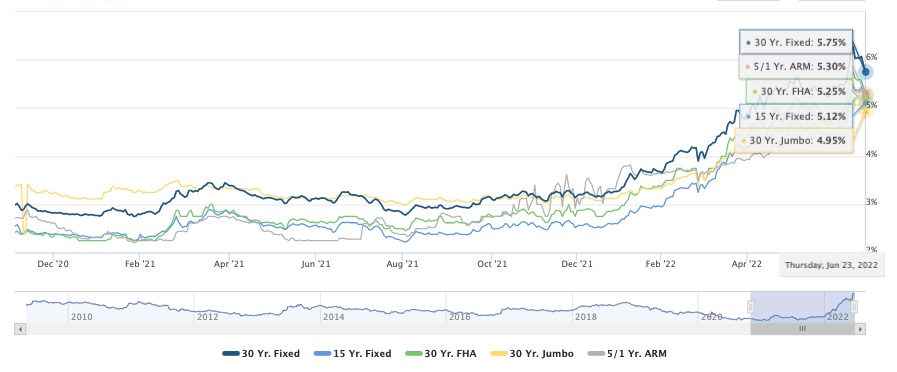

St Louis Interest Rates St Louis Real Estate News

Category Insights Mercer Capital

St Louis Interest Rates St Louis Real Estate News

St Louis Interest Rates St Louis Real Estate News

Consumers Can Handle Fed Tightening Their Debts Delinquencies Foreclosures Collections And Bankruptcies Wolf Street

Tougher Times For Home Loan Approvals Japan Property Central

Dave Ramsey In Most Places Homes Cost A Lot More Than This Example But The Proportions On This Comparison Remain The Same A 15 Year Mortgage Is The Only Way To Go

30 Ways To Help You Save More Money Money Savvy Budget Mom Borrow Money

Grant Recipients Updated Illinois Prairie Community Foundation

Post By Edmund Simms Commonstock Fed Watch Credit Creation Cause Effect August 10 2022

Do Nudges Reduce Borrowing And Consumer Confusion In The Credit Card Market Adams 2022 Economica Wiley Online Library

Fewer Subprime Consumers Across U S In 2021 Experian

Credit Card Debt Statistics For 2022 The Ascent

Oportun Provides Business Update Oportun Financial Corp

5 Financial Goals You Should Achieve By Age 30 Forbes Advisor